Current Sales Tax In Illinois . Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the state sales tax rate in illinois is 6.250%. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Web illinois sales tax calculator. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Web gasoline & fuel excise taxes. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. Use our calculator to determine your exact. Sales tax on cars & vehicles. The term “sales tax” actually refers to several tax acts. With local taxes, the total sales tax rate is between 6.250% and 11.000%.

from printableformsfree.com

Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Web gasoline & fuel excise taxes. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Use our calculator to determine your exact. Web the state sales tax rate in illinois is 6.250%. The term “sales tax” actually refers to several tax acts. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. Web illinois sales tax calculator. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code.

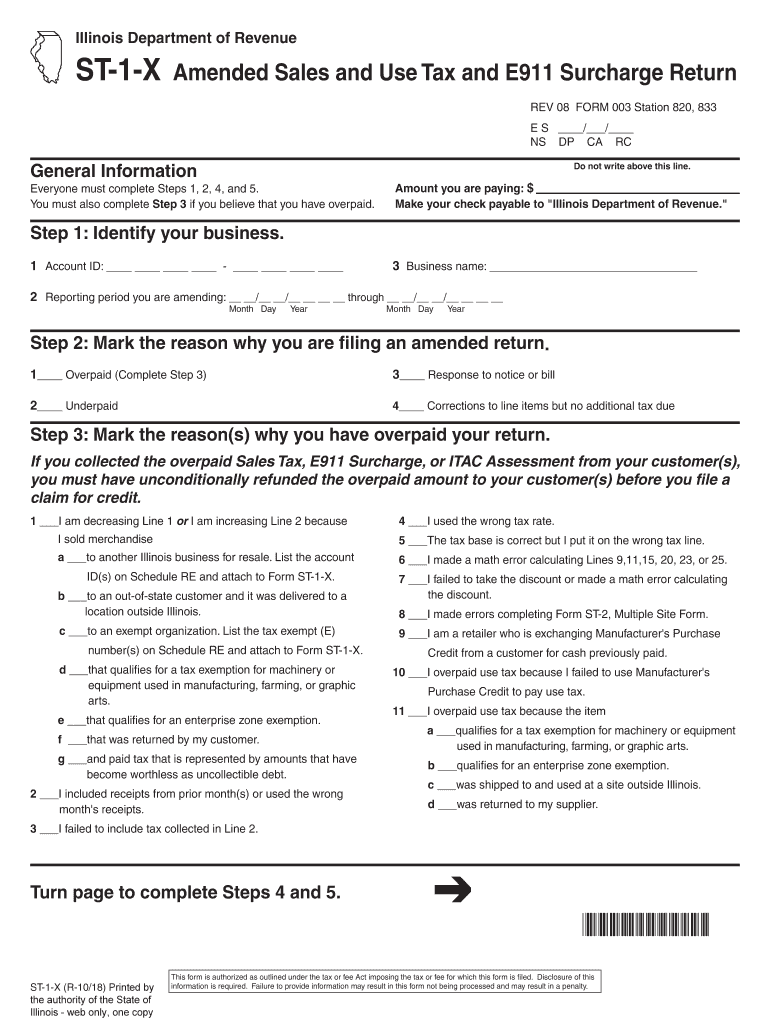

Printable Illinois Tax Forms Printable Forms Free Online

Current Sales Tax In Illinois Web illinois sales tax calculator. The term “sales tax” actually refers to several tax acts. Web gasoline & fuel excise taxes. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web the state sales tax rate in illinois is 6.250%. Web illinois sales tax calculator. Use our calculator to determine your exact. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Sales tax on cars & vehicles.

From www.eztaxreturn.com

2022 State of Illinois Tax Rebates Current Sales Tax In Illinois You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Web gasoline & fuel excise taxes. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties. Current Sales Tax In Illinois.

From printableformsfree.com

Printable Illinois Tax Forms Printable Forms Free Online Current Sales Tax In Illinois Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. The term “sales tax” actually refers to several tax acts. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Sales tax on cars & vehicles.. Current Sales Tax In Illinois.

From www.illinoistax.org

Taxpayers' Federation of Illinois Sales & Excise Taxes How Does Current Sales Tax In Illinois You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Web gasoline & fuel excise taxes. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. Web illinois sales and use tax. Current Sales Tax In Illinois.

From www.formsbank.com

Form Pst1X Amended Prepaid Sales Tax Return Illinois Department Current Sales Tax In Illinois Web the state sales tax rate in illinois is 6.250%. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties. Current Sales Tax In Illinois.

From www.illinoispolicy.org

Illinois now home to the highest sales taxes in the Midwest Current Sales Tax In Illinois The term “sales tax” actually refers to several tax acts. Web illinois sales tax calculator. Sales tax on cars & vehicles. Web gasoline & fuel excise taxes. Use our calculator to determine your exact. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Web illinois sales and use. Current Sales Tax In Illinois.

From www.taxuni.com

Illinois Sales Tax Current Sales Tax In Illinois Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Sales tax on cars & vehicles. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web the state sales tax rate in illinois is 6.250%. Web illinois sales tax calculator. Web gasoline & fuel excise. Current Sales Tax In Illinois.

From webinarcare.com

How to Get Illinois Sales Tax Permit A Comprehensive Guide Current Sales Tax In Illinois With local taxes, the total sales tax rate is between 6.250% and 11.000%. Sales tax on cars & vehicles. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Use our calculator to determine your exact. Web the state sales tax rate in illinois is 6.250%. Web gasoline &. Current Sales Tax In Illinois.

From taxsalestoday.blogspot.com

Tax Sales Illinois Tax Sales Rate Current Sales Tax In Illinois You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il. Current Sales Tax In Illinois.

From blog.accountingprose.com

Illinois 2023 Sales Tax Guide Current Sales Tax In Illinois Web gasoline & fuel excise taxes. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Web the state sales tax rate in illinois is 6.250%. The term “sales tax” actually refers to several tax acts. You can use our illinois sales tax calculator to look up sales tax. Current Sales Tax In Illinois.

From ledgergurus.com

Illinois Sales Tax LedgerGurus Current Sales Tax In Illinois Web the state sales tax rate in illinois is 6.250%. Use our calculator to determine your exact. Web illinois sales tax calculator. With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the illinois sales tax rate is 6.25%. Current Sales Tax In Illinois.

From 1stopvat.com

Illinois Sales Tax Sales Tax Illinois IL Sales Tax Rate Current Sales Tax In Illinois With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web illinois sales tax calculator. Use our calculator to determine your exact. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. The term “sales tax” actually refers to several tax acts. Web gasoline & fuel. Current Sales Tax In Illinois.

From illin.is

Sales tax hikes take effect in 50 Illinois taxing districts Current Sales Tax In Illinois Web the state sales tax rate in illinois is 6.250%. Web illinois sales tax calculator. The term “sales tax” actually refers to several tax acts. Web gasoline & fuel excise taxes. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Sales tax on cars & vehicles. Web local tax rates in illinois. Current Sales Tax In Illinois.

From www.illinoistax.org

Taxpayers' Federation of Illinois An Illinois Sales Tax Conundrum Current Sales Tax In Illinois You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Sales tax on cars & vehicles. Web the state sales tax rate in illinois is 6.250%. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Web illinois. Current Sales Tax In Illinois.

From www.illinoistax.org

Taxpayers' Federation of Illinois Sales & Excise Taxes How Does Current Sales Tax In Illinois With local taxes, the total sales tax rate is between 6.250% and 11.000%. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the state sales tax rate in illinois is 6.250%. Sales tax on cars & vehicles. You can use our illinois sales tax calculator to look up sales tax rates. Current Sales Tax In Illinois.

From forixcommerce.com

How Illinois Online Sales Tax Rules Could Change Your Business Current Sales Tax In Illinois You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Web the state sales tax rate in illinois is 6.250%. Web gasoline & fuel excise taxes. Web the illinois sales tax rate. Current Sales Tax In Illinois.

From www.illinoispolicy.org

Illinois sales tax revenues down 24 in May amid strict lockdown Current Sales Tax In Illinois The term “sales tax” actually refers to several tax acts. Web the illinois sales tax rate is 6.25% as of 2024, with some cities and counties adding a local sales tax on top of the il state. Web illinois sales and use tax rates in 2024 range from 6.25% to 11% depending on location. Sales tax on cars & vehicles.. Current Sales Tax In Illinois.

From aprilqkimbra.pages.dev

Illinois State Sales Tax Rate 2024 Devan Fenelia Current Sales Tax In Illinois The term “sales tax” actually refers to several tax acts. Web the state sales tax rate in illinois is 6.250%. You can use our illinois sales tax calculator to look up sales tax rates in illinois by address / zip code. Use our calculator to determine your exact. Sales tax on cars & vehicles. Web illinois sales and use tax. Current Sales Tax In Illinois.

From jennettewmegen.pages.dev

Il Sales Tax Due Dates 2024 Aidan Rickie Current Sales Tax In Illinois Web gasoline & fuel excise taxes. Use our calculator to determine your exact. Web local tax rates in illinois range from 0% to 4.75%, making the sales tax range in illinois 6.25% to 11%. Web the state sales tax rate in illinois is 6.250%. You can use our illinois sales tax calculator to look up sales tax rates in illinois. Current Sales Tax In Illinois.